In 2002, the United States Congress passed the Sarbanes-Oxley Act (SOX) to safeguard stakeholders, shareholders, and the general public from accounting and financing errors to fraudulent practices by business entities and corporations. The primary objective of SOX compliance is to improve the accuracy of corporate disclosures by increasing transparency in financial reporting through a formalized system of checks and balances. The act has set the deadlines for corporations to meet compliance and has published a rulebook on the requirements needed to maintain it. The Sarbanes-Oxley Act was introduced by Congressman Paul Sarbanes and Michael Oxley to guard the corporate governance and accountability from financial scandals.

SOX compliance is not just legislation businesses need to follow but also a best practice to secure internal financial systems. Companies need to comply with SOX for their financial and IT departments. SOX has entirely changed the way the IT departments store electronic records. Although the legislation doesn’t define the way businesses need to store records, it dictates which records are important to store and for how long. Corporations need to save all their business records, including electronic records and messages, for at least five years to meet SOX requirements. By implementing SOX financial security controls, corporations can protect their sensitive data from theft and cyberattacks.

Who Needs to Comply With SOX?

All the publicly traded companies that do business with the United States need to meet SOX compliance. IT departments are responsible for creating and maintaining corporate records. They need to prove compliance by providing documentation that ensures the employer has met the mandatory data security thresholds. IT departments need to be familiar with access privilege and log management standards to align with SOX rules and regulations. They should seek cost-effective solutions that fulfill the need for SOX compliance. Rules with a profound impact on records management are as follows:

Rule 1: Results in penalties if records are altered or modified due to any reason.

Rule 2: Outlines the retention period for record storage.

Rule 3: Defines the type of business record to be stored.

4 Benefits of SOX Compliance

SOX compliance has brought a major shift in the internal controls of the companies as they have started focusing more on risk management and the way the compliance needs to be aligned with business objectives to sustain business core values.

- Prioritizing Risks

- Improve Performance of Audits

- Strengthening Internal Business Control

- Centralized Financial Reporting

1. Prioritizing Risks

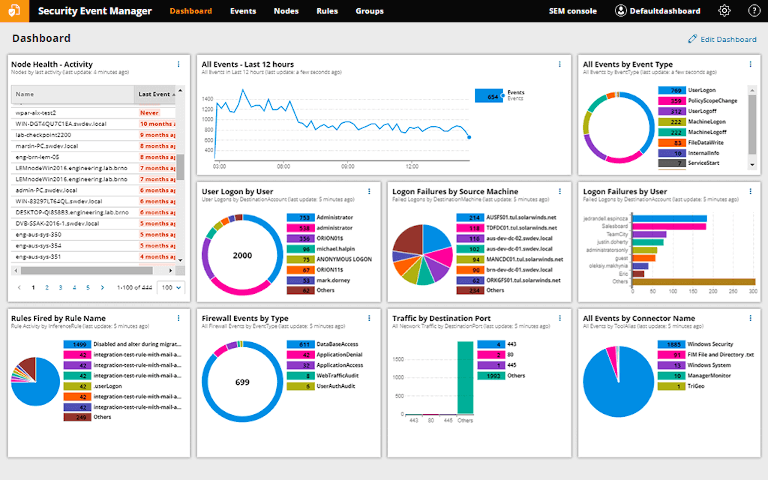

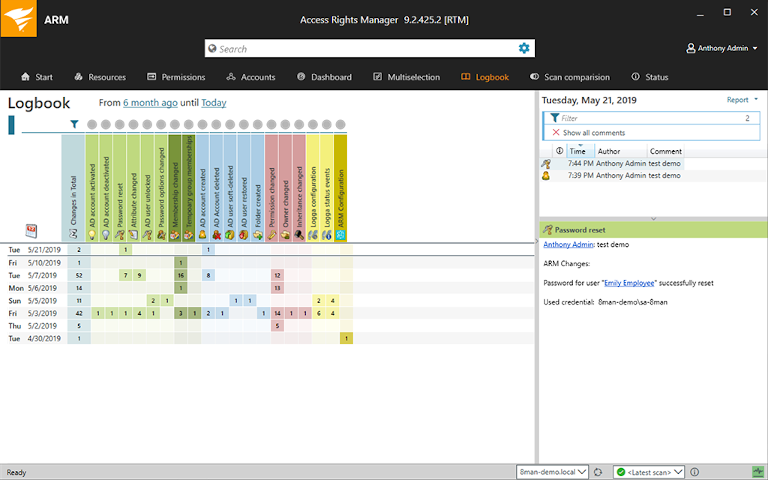

Organizations typically prefer having a consolidated view of business risks and objectives. By incorporating comprehensive risk/event management tools such as SolarWinds® Security Event Manager and Access Rights Manager, businesses achieve transparency and corporate-wide visibility of processes to help in the timely mitigation of risks. These tools monitor the overall operational performance and help secure your business by increasing anti-fraud activities.

2. Improve Performance of Audits

The establishment of the Public Company Accounting Oversight Board (PCAOB) for the assessment of personal liability has reduced the gap between the purpose of audits and their fulfillment. PCAOB was introduced to manage accounting decisions. It made audits an independent assurance to evaluate the operational effectiveness of the risk management measures taken by organizations and government control processes.

3. Strengthening Internal Business Control

Section 302 and 404 of SOX requires documentation of controls, including recorded control processes, operation manuals, and personnel policies. The steps needed to meet compliance are not only productive for organizations but also lead to long-term financial success. Still, many organizations find the process overwhelming and expensive. With standard frameworks, organizations can strengthen their internal control structure and streamline the documentation of various control processes. Strengthening internal business control leads to effective operations and reliable financial reporting.

4. Centralized Financial Reporting

Businesses need to go through extensive tests of internal controls and certifications of accuracy to meet SOX compliance. This encourages businesses to maintain the quality of financial reporting, automate and centralize it. Businesses need to invest in risk management tools that assure financial accuracy and meet compliance, leading to business continuity and growth.

SOX Compliance Audits

SOX compliance audit is a mandatory assessment and evaluation of the organization’s internal controls once in a year. To complete the audit, companies need to hire independent auditors. SOX audits usually involve the verification of the organization’s financial statements. Auditors compare past statements with the current financial statement and determine whether the results are satisfactory. Auditors can also interview employees to ensure regular duties match their job profile.

How to Prepare for a SOX Compliance Audit

Performing a self-audit helps companies prepare for a SOX compliance audit. Organizations can also set up an in-house audit team who can help prepare for the SOX audit. Outlined below are some steps companies can follow to identify and resolve issues before an external SOX audit.

- Reviewing employee training

- Use technology

- Have an audit trail

- Integrate file integrity monitoring (FIM)

What Types of Software Can Assist With SOX Compliance?

Due to the confusing, burdensome, and high-stake nature of compliance reporting, it’s important to choose a software that automates various tasks necessary for audits. SolarWinds Security Event Manager offers SOX compliance software. It flags security threats, tracks relevant data, and generates compliance reports.

SolarWinds Security Event Manager

The tool also offers security information and event management (SIEM) capabilities, log management, and trends analysis, and can highlight important information. The SIEM tool can automatically detect security threats, identify malware, and unauthorized access. SIEM tools also send notifications and alerts teams if it detects any suspicious activity. You can try SEM free for 30 days.

SolarWinds Access Rights Manager

SolarWinds Access Rights Manager tool helps secure an organization’s network from unauthorized access. It limits external access, minimizes the impact of insider threats, prepares compliance reports and fast and accurate account provisioning, and identifies and monitors high-risk accounts and reduces data loss. ARM can be used free for 30 days.

How to Maintain SOX Compliance

The best plan of action for companies to demonstrate SOX compliance is to have the correct security controls and ensure financial data is accurate. Relying on appropriate tools and following best practices can help automate compliance needs and reduce the cost of SOX management. Context-aware data classification tools must be used to classify confidential documents, tag electronic health records, financial data, and other structured and unstructured data. These tools also offer free trial versions, so teams can analyze how the tool works and how efficient it is to meet SOX compliance requirements.